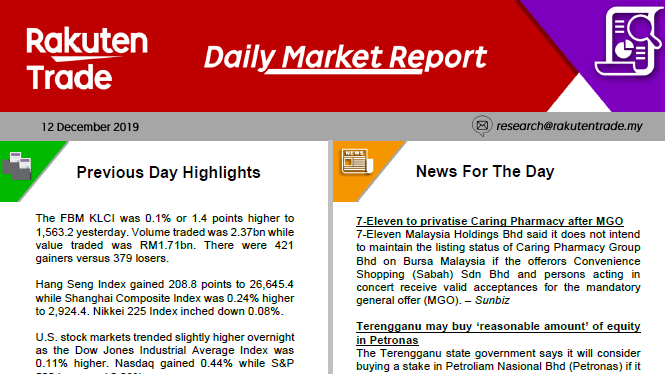

Daily Market Report (12 Dec 2019)

Thu, Dec 12, 2019 8:55 AM

- Indication from the Federal Reserves that rates will remain indefinitely induced some profit takings on treasuries with the US 10-year yield touching 1.80% from 1.75% before.

- We would expect bonds to experience some selling pressure going forward thus may see the same on the MGS. Meanwhile trading on equities are anticipated to remain nonchalant with the US China trade talk still undecided.

- Locally, we expect another flattish day with the FBM KLCI looking to re-test the 1,565 mark as chances for a shift in portfolio adjustments from bonds to equities are highly likely.