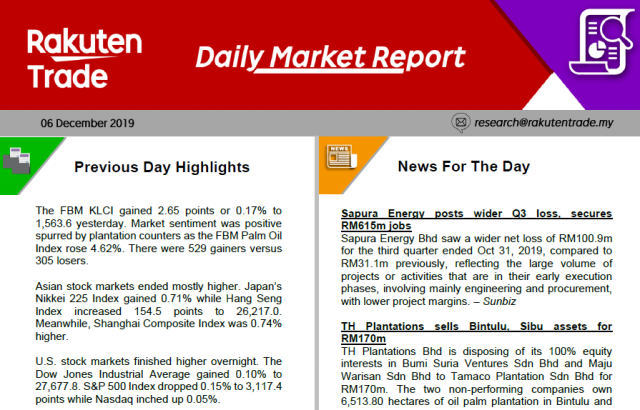

Daily Market Report (6 Dec 2019)

- Expectations of further cuts in crude oil production may see oil prices to trend higher which in turn will spur production of bio fuel. While Brent price has climbed to almost US$64/barrel, CPO has also trended higher at almost RM2,775/MT.

- These may induce buying interests to centre on both the Oil & Gas and some Plantation companies. Following yesterday’s positive close for the FBM KLCI, we expect the buying momentum to persist albeit at a slower pace.

- Expect the FBM KLCI to test the 1,570 level today.