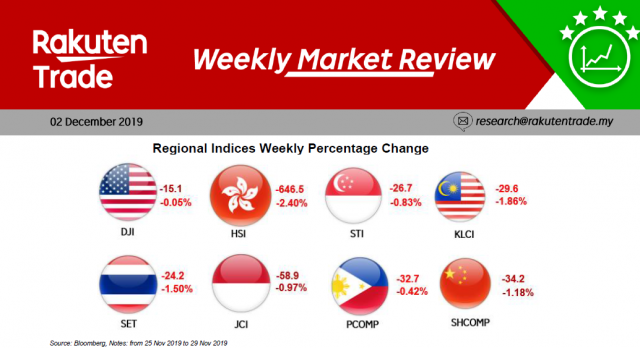

Weekly Market Review (2 Dec 2019)

- Major global indices were in negative territory last week. Hong Kong equities were heavily sold down amid the political uncertainty as the HSI lost 646.5 points to settle at 26,346.5 last week. On the local front, FBM KLCI tumbled 29.6 points to 1,561.4.

- Weekly foreign fund flows were negative with a total net outflow of RM761.22m. Year-to-date net outflow hit a massive RM9.9bn. There was only 1 gainer against 28 losers in KLCI last week.

- The performer was HLB (+0.84%) while the top 3 losers were PETGAS (-4.91%), PETDAG (-4.18%) and AXIATA (-3.95%).