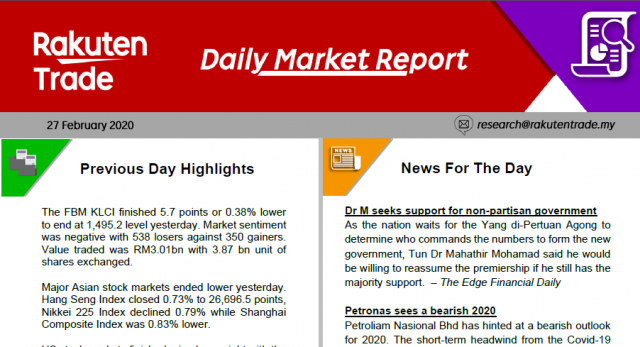

Daily Market Report (27 Feb 2020)

- US markets which have taken a beating for the past week will certainly play a part on the regional markets as sentiments remains jittery as Covid-19 numbers continue to grow outside China.

- On the local front, the market will largely be focusing on the political updates hence sentiment could be muted hovering around the 1,500 level. Investors should adopt a buy on weakness strategy for trading purposes.