Daily Market Report (19 March 2020)

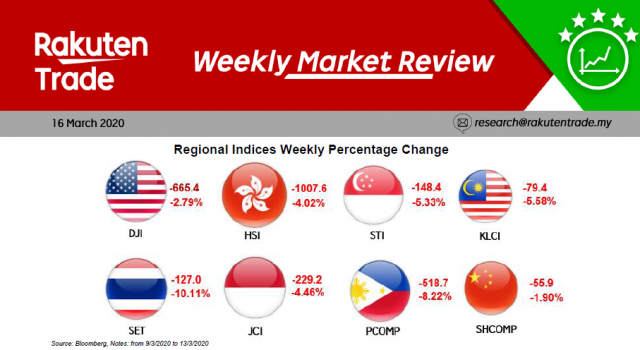

- Nowhere to hide as one can expect another rout for the regional markets today following the trashing on Wall Street.

- We believe investors are reverting to “cash is king” as even the US treasuries were sold down as well. The US 10-year yield climbed from a low of 0.7% a few days ago to now around 1.2%.

- Locally, we may see more downside bias for the FBM KLCI with 1,220 as the immediate support after which the 1,200 would be the psychological support level.