Daily Market Report (21 Jan 2020)

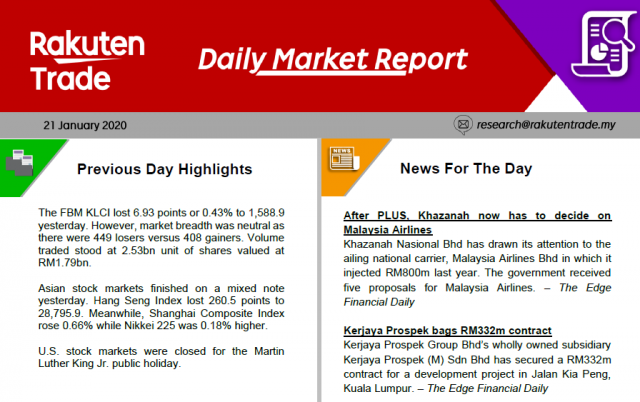

- Following yesterday’s downtrend of the FBM KLCI to below the 1,590, we expect similar trading pattern to remain albeit at a less drastic manner.

- Therefore, we reckon the benchmark index to hover within a tight range of between 1,585/90 today.

- Meanwhile, we believe interests on the Construction sector to emerge rather soon as we have seen a number of positive news flow within the sector of late. Keep an eye on the Contractors.