Daily Market Report (14 Jan 2020)

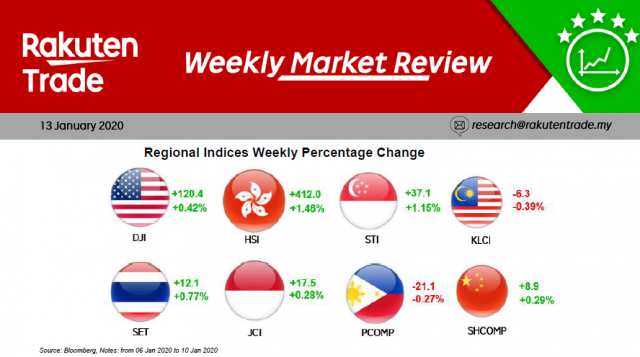

- US markets continues its bullish run with index as Nasdaq and S&P hit record high on the trade deal optimism coupled with reports that US plans to remove China from a list of currency manipulators.

- Regional markets are expected to follow suit and trend higher today.

- However, our local FBM KLCI continues to lag and stayed below 1,600 level.

- Nonetheless, the small mid cap and technology has been the bright spot and we expect it continue and investors should look at tech related stocks such like UWC, Dufu, MI Tech, JCY and Notion.