Daily Market Report (11 Nov 2019)

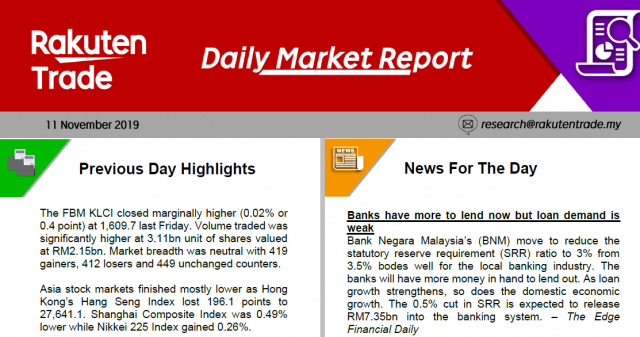

- We laud Bank Negara’s (BNM) move to cut the Statutory Reserve Requirement (SRR) by 0.5% which will release around RM7bn to 8bn into the system. We are strong advocate for such move as this will be a more effective instrument than the usual cut in interest rates.

- By doing so, BNM is able to maintain attractive yields in Malaysia which should attract more foreign funds flowing into the country as depicted from the recent strengthening of the Ringgit.

- Additionally, such a move should be positive for the Banks and we expect buying interests on the banks to continue. As for the FBM KLCI, we anticipate it to challenge the 1,620 mark today.