Daily Market Report (29 Oct 2019)

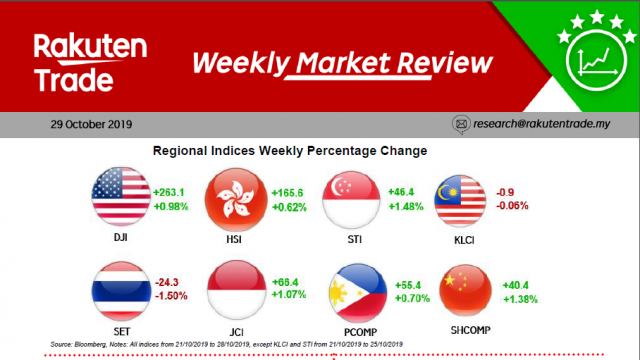

- US stocks surged to new highs supported by encouraging results plus expectations of a positive outcome from the US/China Trade talk.

- However, many are expecting more rate cut during the FOMC meetings over the next 2 days and may trigger portfolio realignments again following the US 10-year Treasury rate touching a 6-week high recently above the 1.8%. In view of this, we do not foresee market volatility to diminish anytime soon.

- Nonetheless, we reckon the local bourse to be relative well supported at current levels with focus again centred on the lower liners.