Daily Market Report (29 July 2019)

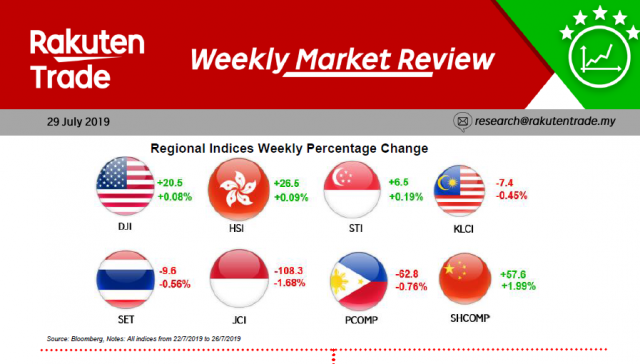

- Equity markets are set to remain rather volatile in view of the ongoing corporates earnings in the US which has been less than impressive so far. In addition, fresh protests in Hong Kong could further exacerbate the already fragile buying sentiments.

- Therefore, we reckon the FBM KLCI to remain stuck within a range of 1,640-1,660 over the immediate term.