Daily Market Report (13 Aug 2019)

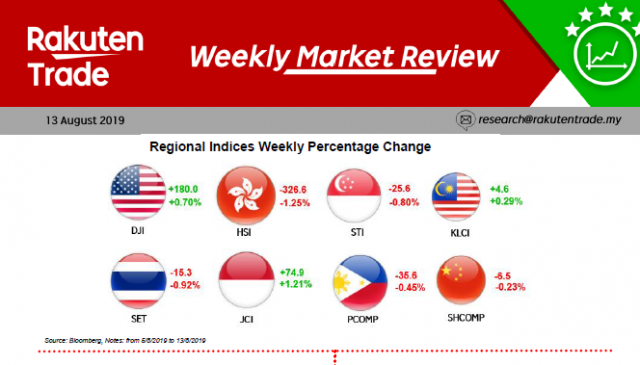

- Dow Jones Industrial Average Index tumbled 389 points yesterday amid the heightened uncertainties of US-China Trade war. The 10-year treasury yield dropped to 1.64%, its lowest since October 2016.

- We expect KLCI to remain volatile due to global markets uncertainties. Hence, we recommend investors to buy on weakness with focus on the heavily oversold index-linked counters, and keep an eye on bargain hunting on small mid cap stocks and construction related stocks