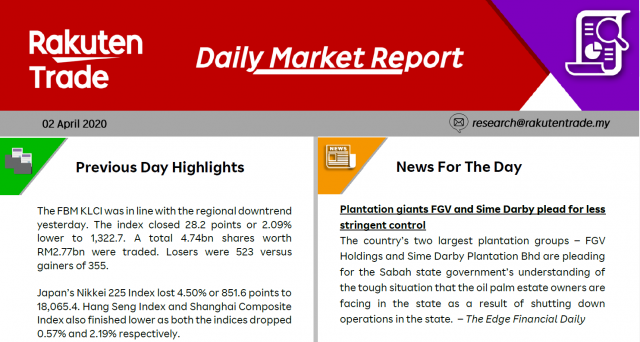

Daily Market Report (2 April 2020)

- Investors sentiments again were severely tested yesterday as Wall Street saw another wave of selling.

- The DJI Average declined by almost 1,000 points on concerns over the US economic health as Covid-19 cases in the US has broken the 200,000 mark.

- With this, we reckon regional markets may experience some selling pressure today.

- Locally, following the FBM KLCI decline yesterday breaking the 1,330 support level effortlessly, we envisage the next support at 1,300 to be under threat.