Daily Market Report (11 June 2019)

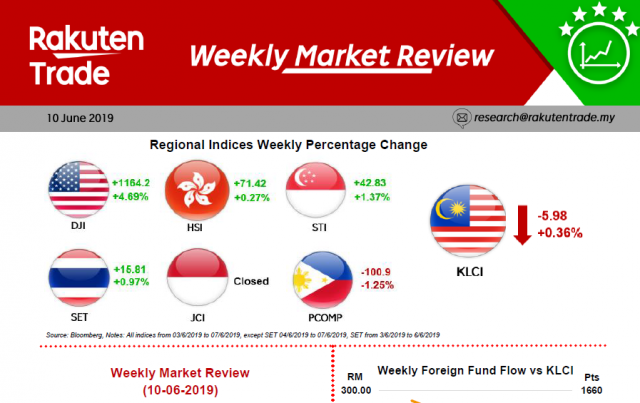

- Equities may be back in favour judging by the resurgence of major global indices.

- The Dow Jones Industrial Index have had an impressive rebound from below 25,000 to now 26,062. Similarly, regional markets also staged a rebound of sorts.

- We believe this uptrend to persists in view of expectations that the Federal Reserves may be looking to reduce interest rates which have already been reflected from the downtrend of the US 10-year Treasury rates now at 2.15% from the high of 2.80% earlier this year.