Daily Market Report (17 June 2019)

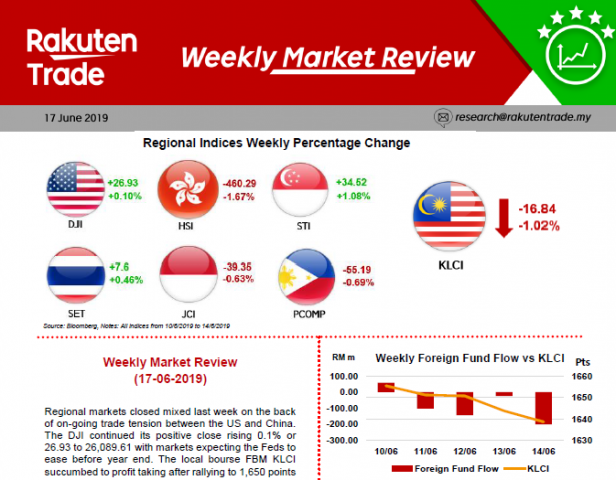

- It was shortlived. Foreign funds inflows which started the month of June on a positive note has now turned negative again. For the first week of the month, net foreign inflows totalled RM409m before foreign fund reverted to their selling mode again.

- Last week saw another RM469m of foreign net outflow pushing month to date flows to a -RM60m. However, we expect foreign flows to be positive in view of the imminent rate cut in the US which should see funds returning to higher yield investment destinations.