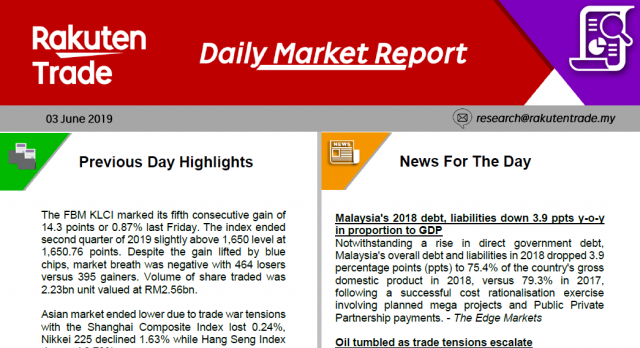

Daily Market Report (03 June 2019)

- Trump may have shot himself in the foot as his bullying tactics failed to yield any results so far. Instead, his antics have riled the Chinese so much so that, US firms in China may be under some scrutinization going forward.

- Recently, Germany have had also condemned Trump’s tactics thus indicating his support is waning. With China unwilling to back down, we reckon global markets will continue to be volatile until investors are fed up with the whole process only then we can expect business as usual.