Weekly Market Review (3 Sept 2019)

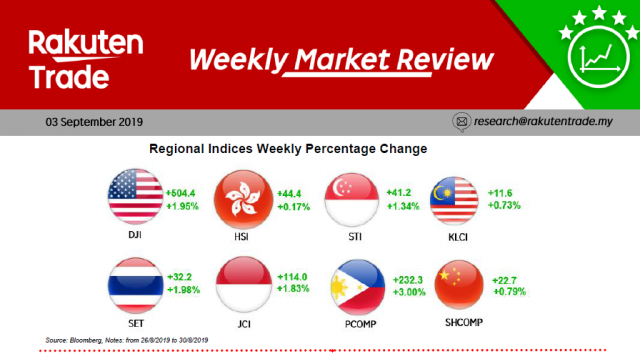

- Major stock markets rebounded last week from the major sell down with the Dow Jones Industrial Average closing above 26,000 level to 26,403.4 points. The FBM KLCI also closed firmly above the 1,600 mark at 1,612.14 points.

- Foreign funds continued its risk off mode on emerging markets with our markets seeing reduced outflow of RM324.5m. Performance amongst the FBMKLCI components saw 21 gainers to 8 losers.

- Top 3 performers include SIME (+9.57%), HAPSENG (+3.77%) and PMETAL (+3.58%) while the 3 losers were AIRPORT (-3.86%), PBBANK (-2.31%) and HLB (-2.24%).