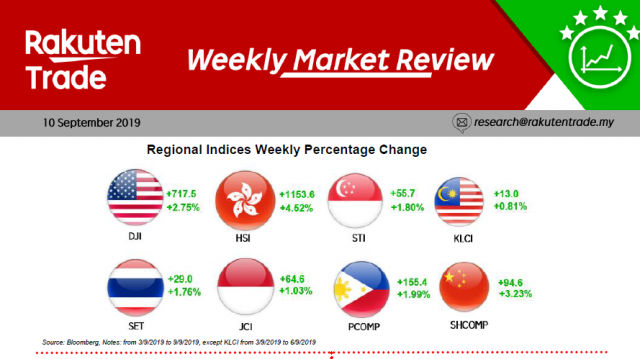

Weekly Market Review (10 Sept 2019)

- Major stock markets continued to rebound last week with the Hong Kong’s Hang Seng Index leading the trend gaining 4.5% or 1,153 points. The FBM KLCI also closed firmly above the 1,600 mark at 1,604.5 points.

- Foreign funds continued to be net outflow for the month with RM278.6m. Performance amongst the FBMKLCI components saw 20 gainers to 9 losers.

- Top 3 performers include MISC (+8.39%), PETDAG (+5.42%) and AMMB (+4.52%) while the 3 losers were AXIATA (-2.40%), HLFG (-2.16%) and DIGI (-1.21%).