Daily Market Report (23 Sept 2019)

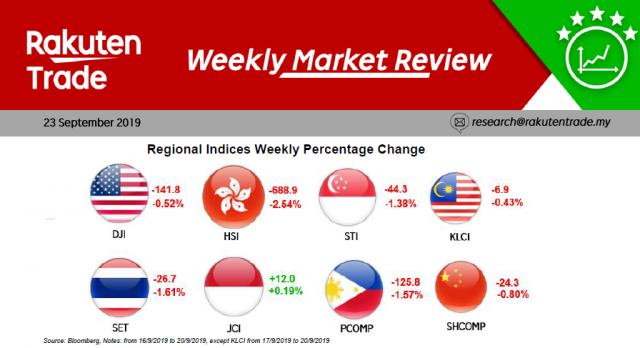

- Uncertainties continue to plague the global financial markets as interest rates are expected to be the major determinant over the course of next few months. As many are expecting the Federal Reserves to further cut rates, the ECB is also seen to be biased towards a lower rate regime.

- Meanwhile, the US 10-year Treasury yield had declined to 1.72% from above the 1.90% level only a week ago as funds returned Treasuries at the expense of equities with the DJI Index closed almost 160 points lower last Friday.

- All said, we can expect another boring day on the local bourse with the FBM KLCI expected to trend between the 1,595-1,605 range today.