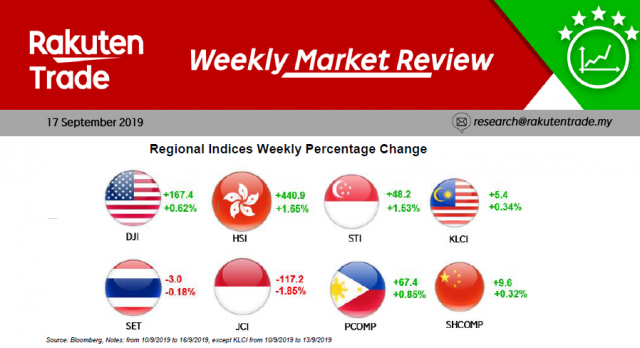

Weekly Market Review (17 Sept 2019)

- Major stock markets mostly posted weekly gain last week following the fresh stimulus from European Central Bank imposing quantitative easing to boost eurozone economy. Brent crude oil price also saw a surge to a high of US$72 after the attack on Saudi Arabia oil site.

- In local market, the FBM KLCI gained 0.34% to 1,601.25. Weekly foreign funds turned positive to RM192.1m of net inflow. Performance amongst the FBMKLCI components saw 14 gainers to 12 losers.

- Top 3 performers include PCHEM (+5.86%), PETDAG (+4.95%) and AXIATA (+3.89%) while the 3 losers were IHH (-1.91%), TENAGA (-1.57%) and DIALOG (-0.85%).