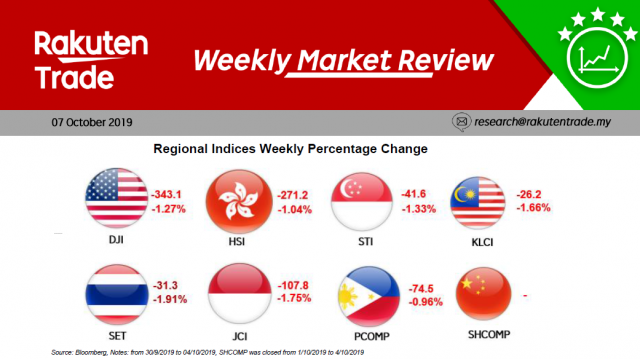

Daily Market Report (07 Oct 2019)

- It is obvious that our equity market as well as our economy are in dire need of a major booster. With Budget 2020 to be tabled this Friday, we are hoping the government will heed the voice of the nation to pump prime both.

- For instant impact, without a doubt tax reduction (both personal and corporate) and the reintroduction of GST albeit at a lower rate would be most welcome by most.

- In addition to this, as mentioned our bankers and developers should also do their part in addressing the prevailing oversupply condition within the property scene.

- For today, we reckon the FBM KLCI would remain in its consolidation rut with some downside bias and see the 1,550 as the immediate psychological support.