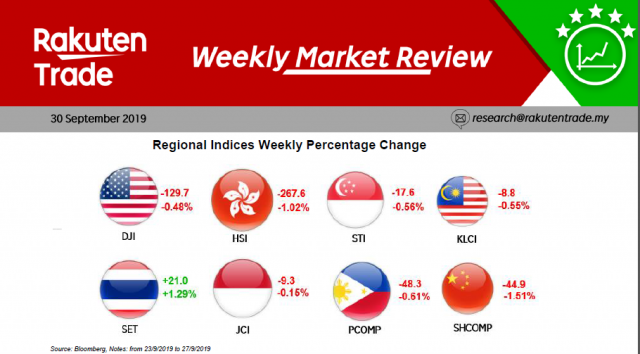

Weekly Market Review (30 Sept 2019)

- Major stock markets ended mostly in negative territory last week amid the slowing down of global economic growth. Shanghai Composite Index fell the most, dropping 1.51% due to disappointing economic numbers from China and the escalating trade tension.

- In local market, the FBM KLCI lost 0.55% to its lowest level since Aug 2015. Weekly foreign funds were negative with RM150.9m of net outflow. Performance amongst the FBMKLCI components saw 10 gainers to 20 losers.

- Top 3 performers include SIMEPLT (+1.05%), AXIATA (+0.93%) and PETDAG (+0.77%) while the 3 losers were TOP GLOVE (-3.79%), GENTING (-3.37%) and DIALOG (-2.02%).